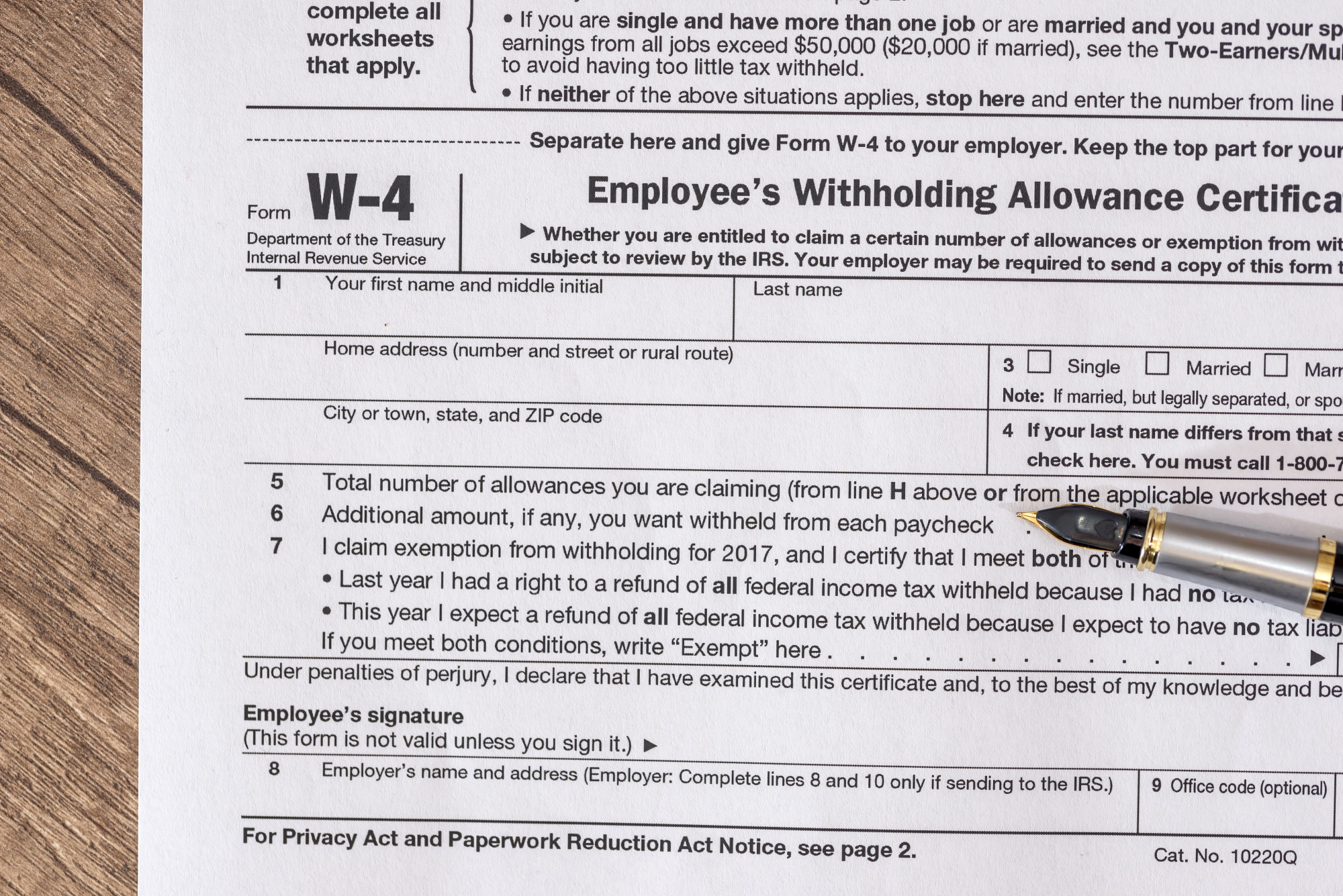

w 4 tax form with pen on desk.

Death and taxes may be the only two things you can’t avoid. And you might want to die to avoid paying taxes!

The average small business owner earns more than $66,000 a year. You have to pay taxes on this money, and you have to pay different types of taxes on the money your business makes. Before you start sending money to the government, you need to do your research on taxes for businesses.

What exactly are income and estimated taxes? When do you pay your money to the government? Do you ever have to pay employee or sales taxes?

Answer these questions and you can figure out how to save money on taxes in no time. Here is your quick guide.

Income Taxes

All businesses that are not partnerships must file an income tax return. If you are in a partnership, you can file an information return instead.

An income tax on your business is on the income your business earns over the course of the year. You can make deductions if you donate to charity or incur expenses.

Estimated Taxes

The business income tax functions as a pay-as-you-go expense, so you must pay money as you earn income over the year. You can pay estimated taxes based on how much you estimate your income levels to be. This lets you make small payments every quarter instead of a large payment at the end.

You must calculate your estimated taxes as precisely as possible. If your estimations are not accurate, you may need to pay a penalty at the end of the year.

You should go to a business tax attorney for help and talk to a financial advisor about business tax advice. You can visit websites like silvertaxgroup.com to find information about attorneys and advisors.

Employee Taxes

You can choose to withhold money from your employee’s paychecks. This lets you pay their income taxes on their behalf.

However, you must report how much money you are withholding to the government and deposit it with the IRS. You also need to pay Social Security, Medicare, and Federal Unemployment Tax Act taxes. These taxes collectively are called employee taxes.

Sales Taxes

In some states, businesses must collect sales taxes and hand them over to the government. You may also need to file a report that indicates how much money in sales taxes you collected.

If you have offices in multiple states, you need to review the laws in each state. You should get help from the IRS so you can cover all regulations and avoid penalties.

The Different Types of Taxes

You need to figure out how different types of taxes work. You pay money from your personal income, but also from your company’s income. Sending in estimated taxes is the easiest way to pay on behalf of your company, though you must make accurate guesses.

Employee taxes are payments you make on behalf of your employees. If you collect sales taxes, you may need to send the money to the government for easy collection.

Paying taxes is just one part of running a small business. Read more small business guides by following our coverage.

Leave a Reply